In today’s fast-paced business environment, accountants are increasingly tasked with managing payroll services for multiple clients. This responsibility demands precision, efficiency, and the ability to handle complex calculations seamlessly. To meet these requirements, choosing the right payroll software is crucial. The best payroll software for accountants not only simplifies processes but also ensures accuracy and compliance across various client needs.

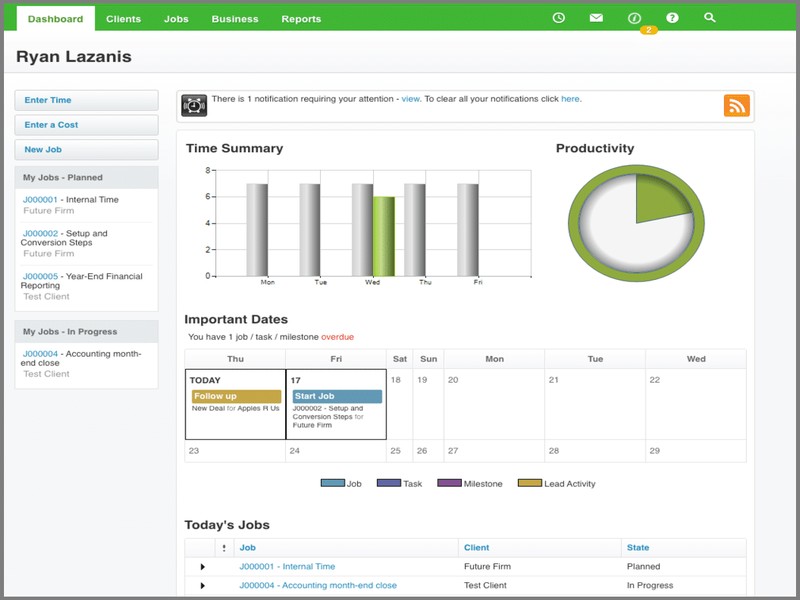

One of the foremost features to consider in payroll software for accountants is its multi-client management capability. An ideal solution should allow accountants to toggle between different client accounts effortlessly while maintaining a clear distinction between each client’s data. This feature helps in avoiding confusion and errors that could arise from handling numerous accounts simultaneously.

Another critical aspect is automation. Payroll processes are often repetitive and time-consuming; therefore, automating tasks such as calculating wages, deducting taxes, and generating payslips can significantly enhance productivity. Automation reduces manual intervention, thereby minimizing errors and freeing up valuable time for accountants to focus on more strategic tasks like financial advising or analyzing business performance metrics.

Integration capabilities also play a pivotal role in selecting best payroll software for accountants typically use a variety of tools—such as accounting software suites—to manage their duties effectively. Seamless integration with existing systems ensures that data flows smoothly without requiring duplicate entries or manual transfers between platforms. This interconnectedness enhances data accuracy and provides comprehensive insights into both payroll specifics and broader financial contexts.

Compliance is another area where robust payroll software proves indispensable. Tax regulations frequently change, varying by jurisdiction and sometimes even by industry sector. Reliable payroll solutions automatically update tax tables according to the latest legislation changes ensuring that all calculations remain compliant with current laws without requiring constant manual updates from the accountant.

User-friendliness cannot be overlooked when choosing suitable software either; it must cater not only to tech-savvy individuals but also those who may be less familiar with digital tools yet require efficient navigation through complex functionalities quickly during peak periods like month-end closings or fiscal year preparations.

Additionally, reporting capabilities within good payroll systems offer customizable reports tailored specifically towards individual client needs which provide detailed breakdowns on aspects such as labor costs per project/client allowing better-informed decision-making regarding workforce allocations based upon real-time analytics provided directly via intuitive dashboards accessible anytime anywhere thanks largely due cloud-based technology advancements today making remote accessibility easier than ever before possible!

Lastly cost-effectiveness remains important especially smaller firms operating tight budgets thus opting scalable solutions offering tiered pricing structures accommodating growth potential alongside immediate operational necessities ultimately delivering maximum value investment long-term success partnerships forged trusted reliable vendors committed continuous improvement innovation forefront industry standards practices globally recognized benchmarks excellence achieved together collaboratively!